|

#1

|

|||

|

|||

|

In response to our previous post Financial Literacy should be made mandatory which talked about conducting workshops and roadshows in spreading financial literacy program in India, Ranjan Varma pointed out two most practical issues

In response to our previous post Financial Literacy should be made mandatory which talked about conducting workshops and roadshows in spreading financial literacy program in India, Ranjan Varma pointed out two most practical issues :

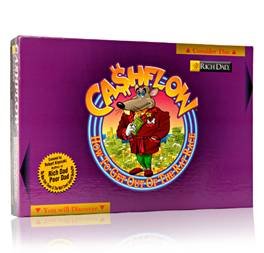

The logic behind keeping them and presenting them as an option was to enable taking the education to those who think they do not need it and to break their personal finance myths. There are few Government Sponsored financial literacy programs in India. RBI, SEBI, and now PFRDA has also sought funds to promote financial literacy in India. Lets take just one example to see how these regulators promote financial literacy in India. Financial Education and RBI The Reserve Bank of India has undertaken a project titled “Project Financial Literacy“. The Objective of the project is to disseminate information regarding the central bank and general banking concepts to various target groups, including, school and college going children, women, rural and urban poor, defense personnel and senior citizens. The project has been designed to be implemented in two modules, one module in which Money Kumar will familiarize you with the role and functions of the Reserve Bank of India; and through the other module, Raju will introduce you to banking concepts. Not many people are aware of any such initiative and that the site was last updated on November, 14 2007 are just few points that shows that like most of the Government schemes, this Financial Education scheme of RBI also had political undertone. Improving Financial Literacy the International Experience Ranjan also pointed out that another big hurdle in spreading financial literacy is the understanding that which programs are useful. Well, one of the best ways to learn is to do. Robert Kiyosaki, of Rich Dad Poor Dad, fame, has an interesting game called Cashflow 101. He feels playing Cashflow 101 is a great way to understand your own level of financial literacy and develop your s****s.  Cashflow 101 Playing Cashflow 101 lets you deal with real-life types of financial situations at no risk so you can learn how to manage your own finances better, get out of the rat race, and achieve financial independence. Cashflow clubs are all about helping each other think, learn and do! Playing Cashflow and other games with others helps you gain a new perspective. There is no speaker or presentations about money management, players learn about managing their money on their own. They employ some real strategies with virtual money and gain knowledge about managing their money. Cashflow 101 boast of a large international community. To find a club in your area just search the club directory online. Other selected financial literacy resources Few other resources that focus on improving the financial literacy of kids and young adults are listed below.  The Mint: This site provides tools to help parents as well as educators teach children to manage money wisely and develop good financial habits.  EconEdLink: A premier source of classroom tested, Internet-based economic lesson materials for K-12 teachers and their students  WIFE.org : The Women’s Institute for Financial Education (WIFE.org) is the oldest non-profit organization dedicated to providing financial education to women in their quest for financial independence. SAP HR Online Training with 5000+ Real Time Screen Shot  Conclusion Financial literacy need not be a boring class room training or a speaker/presentation based format. It can be a fun-filled experience. What is needed is a dedicated, practical effort. Although Government schemes do help but the practical benefit that such schemes offer is too limited. Probably a Public-Private partnership in achieving better financial literacy in India is needed. |