|

|||||||

IPL T20 and Investing – Interesting similarities |

|

|

Views: 2606

|

Thread Tools | Rate Thread |

|

|||||||

IPL T20 and Investing – Interesting similarities |

|

|

Views: 2606

|

Thread Tools | Rate Thread |

|

#1

|

|||

|

|||

|

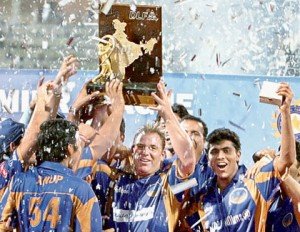

Similarity between IPL T20 and Investing! Don't be surprised, the most popular form of Cricket and your financial planning and investment share a lot of common strategies.

Similarity between IPL T20 and Investing! Don’t be surprised, the most popular form of Cricket and your financial planning and investment share a lot of common strategies. Cricket is indubitably the most popular sport in India. The Twenty20 format specially the Indian Premier League T20 (known as the IPL T20) has generated huge crowd participation encouraged more strongly than in other forms of the game. It has been greatly acknowledged by people and has made huge profits. Speaking of profits, just like teams try to put up a big score on the scoreboard in an IPL T20 action packed, exciting cricket match, you also need to take control of your financial sitution and invest for your better retirement. Kartik Varma, Co-founder of iTrust Financial Advisors has a very interesting analysis that correlates your investment and financial planning strategy with that of IPL T20 cricket game. He lists out 10 things that any one can learn from the IPL T20 about investing.

1. Start Early Starting Early is no-doubt the best way to accumulate wealth. An early start and regular investment can provide our money the much needed compounding growth. For our retirement Planning, we should – Start now, Save more, Retire rich. 2. Risk and Reward tradeoff Risk and Returns are the two most important features of any investment product that are considered in almost all investment related activities viz., stock or portfolio selection, asset allocation, restructuring and performance evaluation. We need to take calculated risk to optimize our returns. Before doing so, Understanding our risk tolerance is of paramount importance. 3. Be ready for the unexpected Greed & Fear have been the two indisputable factors that drive our investments. Some time unexpected event such as the current global financial crisis erode our networth. We should take precautions and invest in various asset classes as per our risk tolerance. 4. Strategic break Just like the strategic break taken after completion of 10th over to re-think the game strategy in IPL T20, we also need to review our financial plan regularly and take corrective actions needed to attain our financial goals. 5. Balance You can not effectively play cricket with 11 batsmen or 11 bowlers. You need to have a balanced portfolio as each type of investment has distinct advantages and disadvantages, and each tends to behave differently in different types of economic conditions. As a long-term investor, your portfolio should be broadly diversified. 6. One bad over Often we go through a rough patch in our life. We may encounter with an accident, medical emergency, job loss or death of an earning member of the fmaily. If we are not adequately prepared such events can derail our financial situation. 7. Consistency gets rewarded Regardless of the amount of money that we have to invest, regular and systematic investment is the best long-term investment strategy. 8. Coaching helps Many of us are not fully aware of the best investment strategy for ourselves. It makes sense to seek guidence from qualified Wealth Manager and Financial Planner such as iTrust Financial Advisors, who believe in HOPE (Honest, One-stop shop, Privacy, Expertise) philosophy. 9. Distractions can be entertaining but ultimately the score matters When it comes to many areas of our life we can rely on our emotions and instincts or gut feelings. But when it comes to investing emotional distraction is a big mistake. We need to control the distraction caused by Greed, Fear or Love while investing. 10. Winning attitude A deciplined approach to investment will help us learn from our financial mistakes and bring out the winner in our self. For a good investor it always pays to follow a rational and well thought out long-term investment strategy. |