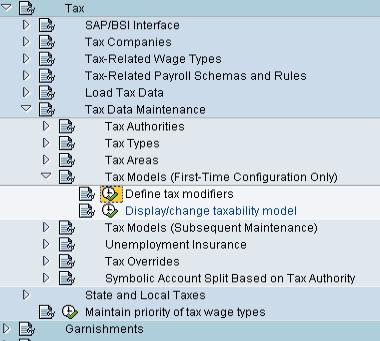

Define tax modifiers

In the first activity in this step, you define tax modifiers in rule

UMOT (

Modifiers for US tax calculation) for your employee groups. You can use these modifiers in the taxability model to differentiate between employee groups that are taxed differently by a tax authority. In the second activity in this step, you replace the call of rule UMOT with your copy of the rule in schema

UTX0 (

US Tax calculation).

Standard settings

As delivered, rule UMOT defines the default employee subgroup (and tax modifier) for all employees as '

U1'. If taxes are determined differently for groups of employees within your organization, you must maintain these groups in rule UMOT.

Activities

Modify rule UMOT:

1. Copy rule UMOT to the customer name range.

2. Modify your copy of the rule if necessary.

3. Save your changes.

Update schema UTX0

1. Wherever UMOT appears in schema UTX0, replace it with your copy of the rule.

2. Save and generate the schema.