Maintain tax-related processing classes

Maintain tax-related processing classes

In this step you set the values for the following processing classes for all tax wage types. This allows you to control the way the wage types are processed by the payroll system.

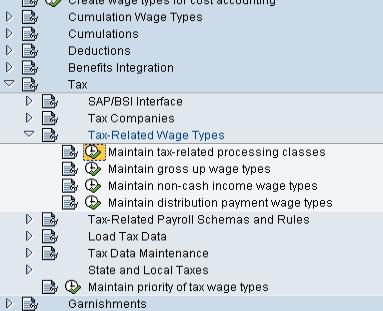

IMG Path & Table: Maintain Tax-Related Processing Classes

Path: Payroll

-> Payroll: USA -> Tax -> Tax-Related Wage Types -> Maintain tax-related processing classes

Table: V_512W_D

The processing classes involved in this step are

Processing class - Definition

---------------------------------

67 Work tax area override proration for supplemental wages

68 Payment type for tax calculation

69 Taxable earning or non-taxable earning

70 Work tax area override proration for salaried employees

71 Wage type tax classification

72 Employer / employee tax

84 Non-cash income type for tax calculation

Note: See

Processing classes used in work tax area override processing for further information on processing classes 67 and 70.

Example: Taxes for wage type M002 (Monthly Salary) should be calculated using the regular method and as the employee's tax liability.

Values to enter:

Processing class 68 - Payment type for tax calculation:

1 Regular method

Processing class 69 - Taxable or non-taxable earnings:

1 Taxable earnings

Processing class 71 - Wage type tax classification:

0 Regular wages

Processing class 72 - Employer/employee tax:

1 Employee tax

Activities For each wage type relevant for taxes, set the values within processing classes 67, 68, 69, 70, 71, 72 and 84 as required.

Summary:

| |

Class

| Definiton

|

67

| Work tax area override proration for supplemental wages

|

68

| Payment type for tax calculation

|

69

| Taxable earning or non-taxable earning

|

70

| Work tax area override proration for salaried employees

|

71

| Wage type tax classification

|

72

| Employer / employee tax

|

84

| Non-cash income type for tax calculation

|

Note: See Processing classes used in work tax area override processing for further information on processing classes 67 and 70.